When you roll your cart into the vast aisles of a Walmart store, a kaleidoscope of payment options awaits you at checkout. Gone are the days when cash and checks were your only pals in the retail journey; today, plastic cards shimmy alongside their tech-savvy cousins—mobile payments.

Walmart, as the retail giant that keeps its fingers on the pulse of the shopping evolution, offers you an array of payment modalities. From the good ol’ cash to debit and credit cards, Walmart has you covered. And if you’re someone who’s all about convenience, then Walmart’s very own mobile payment system, Walmart Pay, might just be your next best friend.

In essence, whether you’re the type who loves the feel of crisp dollar bills or the kind who prefers a quick tap-and-go with a smartphone, Walmart’s checkout lanes are designed to get you through the payment process with ease and a hint of sophistication. After all, the retail experience isn’t just about what you buy; it’s also about the seamlessness of how you pay for it.

Understanding Walmart’s payment options bridges you to modern retail convenience, allowing you to navigate the checkout process like a pro. Now, let’s unwrap this assortment of payment methods, shall we?

How Walmart Pay Works: A Step-by-Step Guide

Let’s dive straight into the heart of Walmart’s modern checkout experience with a handy overview of how Walmart Pay sweeps in to make our shopping lives a breeze.

Imagine you’re standing in the bustling checkout line at Walmart. The carts are full, and shoppers are eager to wrap up their purchases. Now, think of the seamless convenience if you could simply whip out your smartphone and with a few taps, pay for everything. That’s Walmart Pay for you—a digital wallet service right at your fingertips.

Here’s a simplified step-by-step guide to how this nifty piece of technology works. Keep in mind we want this to be crystal clear for anyone who’s just dipping their toes into the world of digital payments.

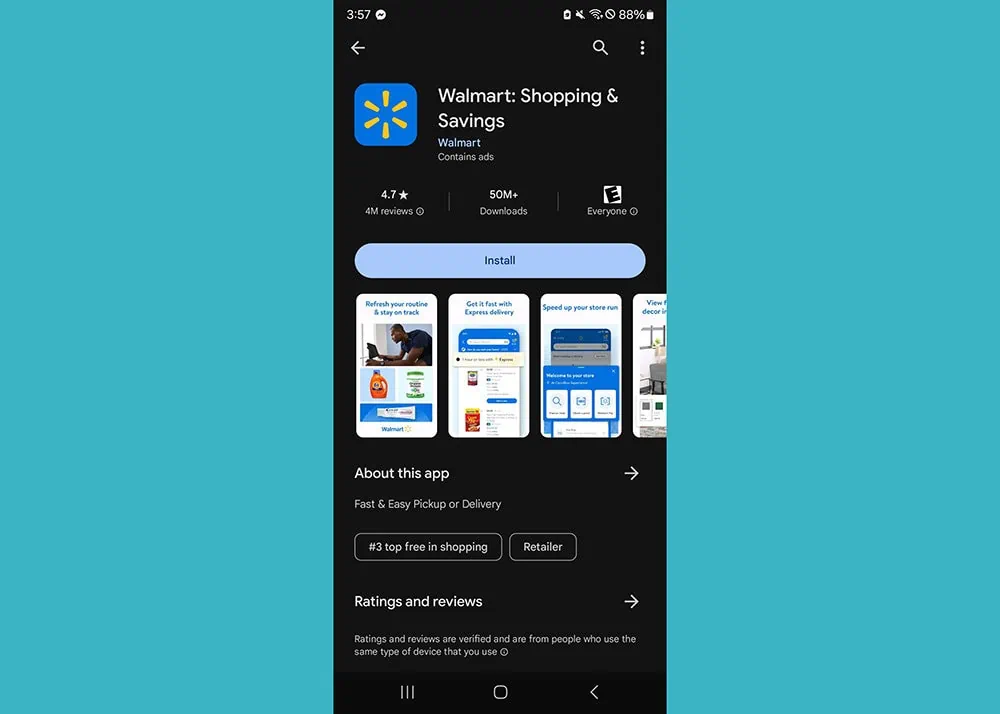

- Download & Set Up: First things first, grab your smartphone—yes, that trusty companion of yours—and download the Walmart app from the Google play store or Apple store. Within the app, you’ll find your path to Walmart Pay. It’s a cinch to set up; just sign in or create a Walmart account if you’re not already part of the family.

- Link Payment Methods: Then, securely connect your preferred payment options. This can be any major credit, debit card, or Walmart gift card. You’re creating a digital vault of sorts, where your cards are safely tucked away for when you need them.

- Shop & Scan: Now, here comes the part that feels a bit like magic. After shopping in-store, open the Walmart mobile app and tap Walmart Pay. Unlock your phone, scan the QR code displayed at the register, and voilà—the app syncs with the checkout system.

- Approval and E-Receipt: As the cashier rings up your items, your phone will display a transaction approval. Once done, you’ll receive an electronic receipt in the app. How neat is that? No more fumbling for paper slips—you’re saving trees while you’re at it!

- Returns Made Easy: And what if you need to return an item? Fear not. That e-receipt is your golden ticket for returns, making the process smoother than ever.

When you use Walmart Pay into your checkout routine, you can shave precious moments off the process, letting you relish in the beauty of efficiency. After all, in today’s fast-paced world, every second counts—something we business enthusiasts appreciate deeply, don’t we?

Lay aside the notion of fishing for your wallet, as life just got a touch more digital—and dare we say, delightful. Next time you’re at Walmart’s register, let Walmart Pay take the lead and step into the streamlined future of shopping.

Keep in mind, that Walmart Pay can securely store your Walmart gift card information as well as your credit or debit card details. Walmart gift cards and your most popular mobile payment method can now be used all in the same application for Walmart purchases or uses in Sam’s Club stores.

Comparing Walmart Pay with Other In-Store Mobile Payment Methods

When stepping into the world of in-store mobile payment options, Walmart’s very own solution—Walmart Pay—certainly deserves a spot in the limelight. But how does it stack up against the other contenders in the ring?

When you open Walmart Pay, you have easy access to touch-free payments but there are other mobile wallets that can be helpful for your grocery pickup.

To begin, let’s consider the ubiquitous payment option, Apple Pay. Loved by many for its sleek interface and ease of use, Apple Pay allows a tap-and-go function that feels almost frictionless. Walmart Pay, while exclusive to Walmart stores, counters with a seamless integration into the retailer’s own app, offering added benefits like immediate access to Walmart’s Savings Catcher and eReceipts.

Next up, we’ve got Google Pay, the Android aficionado’s wallet-less companion. Google Pay beats a similar path with tap-to-pay technology and impresses its users with its wide acceptance. In contrast, Walmart Pay leans on the QR code scanning process at checkout, which, although a smidgen more time-consuming, is still rather swift and secure.

Samsung Pay enters the mix, boasting a technological edge with its Magnetic Secure Transmission (MST) technology. This nearly magical feature lets it be used at virtually any payment terminal. Walmart Pay doesn’t sport this tech, yet it benefits from the sheer volume of Walmart shoppers dedicated to the brand.

It’s worth mentioning services like PayPal and Venmo that are inching their way into the physical retail space. While these options provide a familiar platform for their numerous online users, Walmart Pay’s direct integration with the retailer’s ecosystem offers a brand-centric user experience that extends beyond just payment to include, savings tools, and shopping convenience.

In the dance of mobile payments, each service has its tune. Walmart Pay may not wear the universal tap-to-pay shoes, but it does a two-step right in Walmart’s own backyard, perfectly in sync with the needs of its frequent shoppers. It’s a tailored experience, maybe less about the broad horizon and more about feeling right at home in the aisles of a Walmart store.

One must remember, the best payment method isn’t just about technology—it’s about where you shop, how you like to organize your finances, and ultimately, the convenience you crave. So, while comparing Walmart Pay to its peers, it’s clear that its charm lies within the Walmart ecosystem, and for regulars at the retail giant, that’s a payment method that feels just right.

Online Shopping at Walmart: Payment Methods for a Smooth Checkout

Shopping at Walmart online isn’t just about convenience; it’s about options. When you’re ready to check out, you’ll discover the ease with which you can pay for your goodies. Let’s tour the virtual payment aisle and see what’s on offer.

First up, you have the classics: credit and debit cards. Walmart accepts a wide range of them, ensuring that whether you are a Visa enthusiast or a Mastercard maven, your card is welcomed.

Now, for the tech-savvy shoppers, there’s Walmart’s own eGift Cards. No more losing plastic cards in the depths of a wallet or purse. Your eGift Card lives safely online, waiting to be clicked into action.

Got PayPal? You betcha Walmart hasn’t forgotten the O.G. of online payment systems. With just a few clicks, your PayPal funds transition from cyber space into Walmart space.

And hey, what about Affirm? If splitting your payments over time is more your jam, this option allows you to breathe easy while you manage your budget.

But what about protection and security, you ask? Worry not. Walmart’s checkout is fortified with state-of-the-art encryption, a fancy way of saying your financial info is locked up tighter than a drum.

In summary, no matter how you choose to pay online at Walmart, each transaction is a smooth sail. Cards, eGifts, PayPal, or payment plans – however you swipe or click, it’s handled with the slick efficiency of a Walmart checkout champion. So go on, fill your cart; your preferred payment method is ready for action.

Tips and Tricks for Managing Your Payment Methods at Walmart

Navigating the aisles of Walmart is one thing, but managing your wallet – that’s an art in itself. Let’s talk smart shopping, specifically how to ace managing your payment methods at this retail giant. Everyone loves a good tip, right?

First off, consider linking multiple payment methods to your Walmart Pay. It’s like having a Swiss Army knife in your pocket – be prepared for any purchase situation. Maybe your credit card is the go-to, but having a backup debit card or even a Walmart gift card loaded up can save the day when the unexpected happens.

Have you ever kept track of your spending? If not, start today. Most of us have smartphones glued to our hands; let’s put them to good use. The Walmart app – which you can use for Walmart Pay – is quite the handy tool for reviewing your purchase history. It’s like having a financial diary, giving you the nitty-gritty on where your dollars are dancing away.

And here’s a nugget of wisdom: always keep your app updated. You want to sail through checkout with the grace of a swan, not get stuck because of a tech hiccup. Updates can mean smoother transactions and sometimes new features to make budgeting a breeze.

Now, ever found yourself at customer service because of a payment hiccup? It happens to the best of us. My advice – save your receipts digitally on the Walmart app. A simple snapshot can mean a smooth return or exchange process. It’s about being proactive, not reactive.

Loyalty programs are like that secret ingredient in your grandma’s famous recipe – a sprinkle here can lead to savory savings. If you’re not already part of Walmart’s rewards programs, you’re leaving money on the table. Sign up, scan, and watch the perks pile up like a satisfying stack of pancakes.

Lastly, let’s get real about security. Treat your Walmart account like a treasure chest – guard it fiercely. Strong passwords and being aware of phishing scams can mean the difference between shopping with a smile and frowning at fraudulent charges. Keep those digital pirates at bay, my friends.

Remember, managing your payment methods at Walmart doesn’t have to be like juggling flaming torches. With these tips, it can be a smooth, almost elegant affair – one that keeps your bank account and sanity intact. Happy shopping!

0 Comments