The volume weighted average price (VWAP) will give you the average price based on the volume that was traded and gives traders an idea on the current trends and value of a stock.

This is extremely useful and is used by many institutions for entry and exit points for a stock. Since it is a common technical indicator for large institutions, it will likely be more helpful for stocks with large institutional ownership.

This technical indicator tool is often used for intraday charts (1 minute, 30 minutes, 1 hour, etc.) to determine a good entry or exit price and is represented by a single line on a chart, like a moving average (MA).

For example, let’s look at a stock with a 30-minute interval candlestick chart.

In this case, the black line is the volume weighted average price.

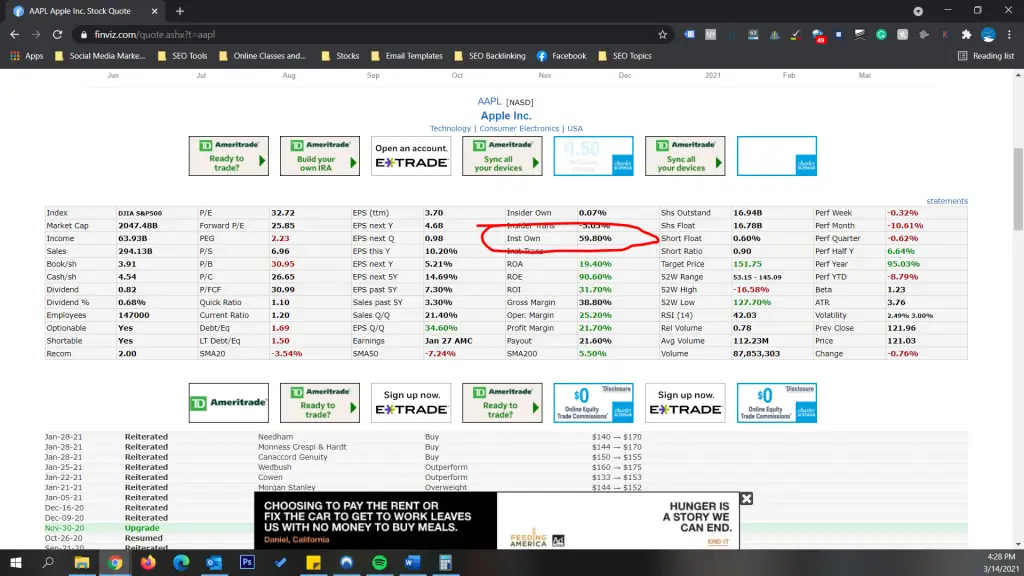

We chose Apple (AAPL) for this example because it has high institutional ownership, which makes for an ideal candidate to use the VWAP.

If we check out the stock on finviz.com we can see that the institutional ownership is 59.80% at this time.

When an institutional trader is trying to find the best entry price for a stock, they are likely going to seek out a price that is below the VWAP, and in the same sense, might decide to short the stock when it is above the VWAP.

How to Calculate VWAP?

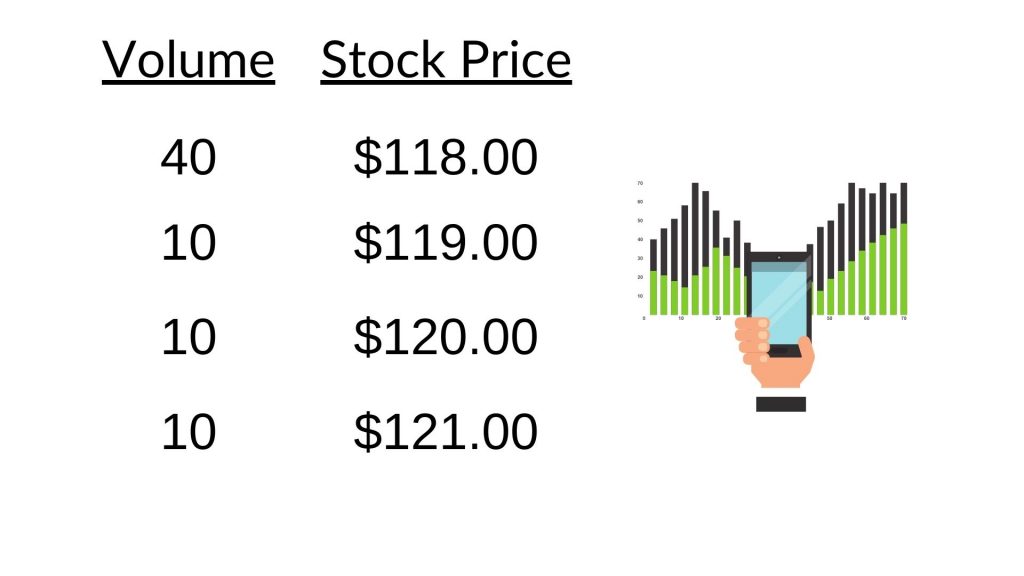

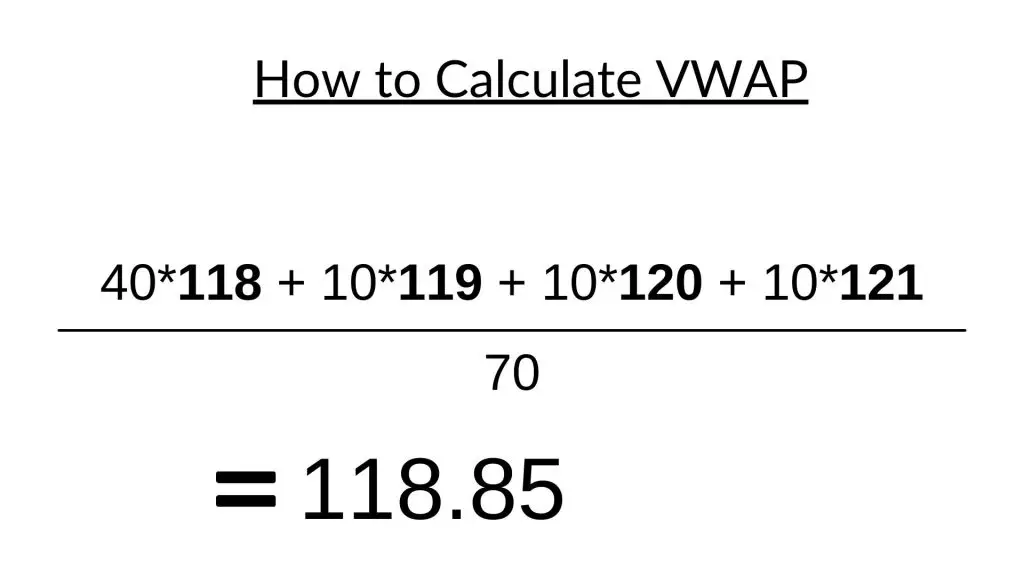

Let’s say for example that during the course of the sessions, 40 stocks are purchased at a price of $118.00, 10 were purchased at $119, 10 at $120, and another 10 at $121 as seen in the screenshot below.

If we are only taking price into account for an average then it would simply be $119.50 but since we are also including volume in the equation, we can tell that the volume weighted average price is going to be closer to $118 since there were more orders at that price than the other prices.

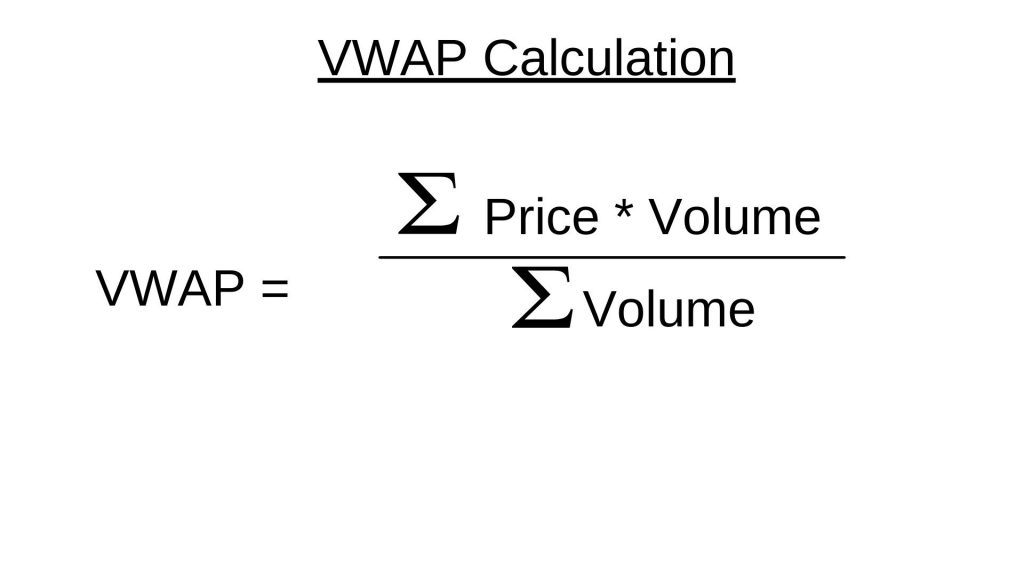

Simply multiple the volume and price of each order together and divide it by the volume total to come up with the VWAP.

The simple equation to determine the VWAP (volume weighted average price) is as follows:

Keep in mind, that while this is an excellent technical indicator to call a good entry or exit point for a stock, it will be best used on a stock with high institutional ownership.

You will often find that the VWAP acts as a resistance or support for a price. While it is a common technical indicator for institutions, it should not be solely relied upon as a strategy for purchasing or selling stocks – it is only one tool and indicator that can assist with a good entry or exit point.

0 Comments