Stock Market: How Does Trading & Investing Work?

What is a stock?

A stock (also known as a share) is a security that gives part ownership in a company. When you purchase shares (big or small), you become a partial owner of that company and this makes you a “shareholder”. This gives you part ownership of their assets, buildings, equipment, and earnings.

What is the Purpose of Stocks? Why would a Company Issue Stocks?

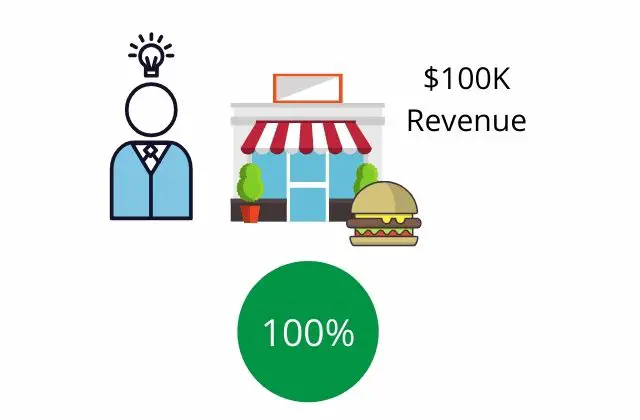

Imagine that you are an entrepreneur that makes the best burgers in town. You decide to open a local restaurant in your town and because you have the best burgers in town, you make a good amount of money by selling to your friends, family, and the community.

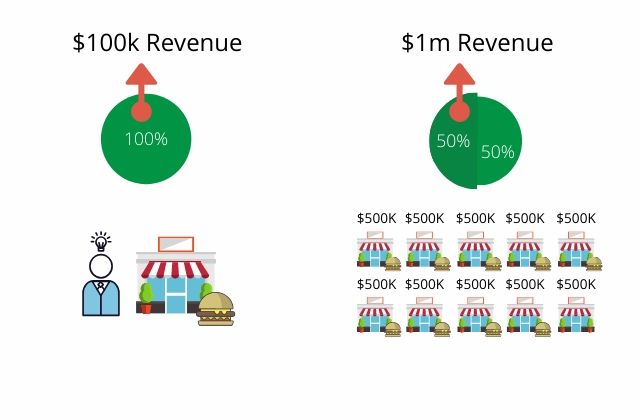

With your success selling burgers in the community, you find yourself making $100,000 a year. You currently own 100% of the company and the revenue generated goes 100% to you.

Let’s say you want to expand your operations on a nationwide or global level.

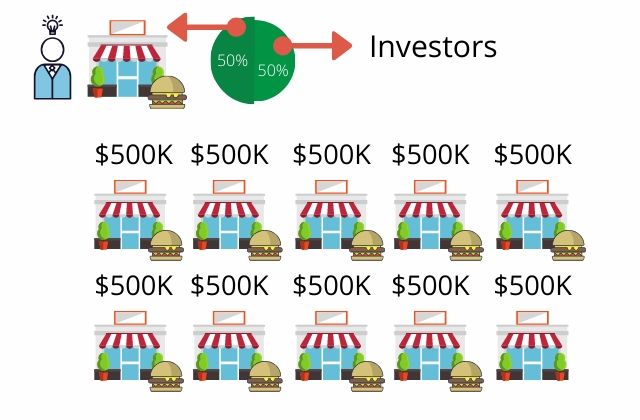

You want to grow your business by building 10 additional stores in the state. Each store is going to cost $500,000 and if you were to put 100% of your revenue towards building these ten stores, it would take 50 years to build those stores. Clearly, you would need additional capital to build the additional stores in a shorter timeframe.

You would need investors. Investors are the key to accessing additional capital for your business to grow and in return for their funds, you would offer them a slice of your company.

Say you keep 50% of the company and offer 50% to investors to help fund your expansion and you see success on the business growth. With this new expansion, the company makes a revenue of $2 million dollars a year and since you own 50% of the company still, you get $1 million.

While you now only own half of the company, you are making 10x more money by growing the business.

Why would Investors want to buy Shares in a Company?

Investors want to own shares in a company to participate in the growth and gain part of the earnings of the company over time. If they have faith in your company and you see large success and growth, they will be able to make money on their investment since they own a part of your business. They will be able to see returns on their investments without doing any of the work.

Investors are not the only players in the game when purchasing and selling stocks. You also have traders, who search for mispricing in shares. They buy shares when they are lower than their actual value and sell them to make money in the short term.

Difference between Investors and Traders

If an individual buys stocks and holds them for many years, they would be considered an “investor”. If an individual buys and sells stocks quickly, they would be considered a “trader”. A trader may hold stock for as little as an hour or could hold stock for as long as a month or more. The important thing to note here is that there is no right or wrong way to go about buying or selling stock.

Being an investor or a trader are both good ways to make money in the stock market and may completely depend on personal preference or risk tolerance.

There are other players on the stock market and just like in a game of poker, it is important to know who you are playing against.

Example of a Publicly Traded Company

Let’s look at Walmart as an example.

At the time of writing this, Walmart has 2.86 Billion shares (known as shares outstanding). That is 2,860,000,000 shares. The price of a single share for Walmart is currently priced at $122.58. If you take the price of a single share and multiply it by the total amount of shares, you get the total value of the company. Using these numbers, we calculate that the total value (otherwise known as market capitalization) is $350.58 Billion dollars.

Although, working with stocks can get tricky since stock prices and market capitalization change quite frequently.

What Makes Stock Prices & Market Capitalization Change?

The prices of stock can change often and quickly due to the law of supply and demand. If more people want to buy stocks (demand) versus selling stocks (supply), then the price increases. If more people want to sell stocks versus buying stocks, then the price will decrease. The real question is: What makes people want to buy or sell a particular stock?

New information.

It can be hard to say exactly what makes a certain stock rise or fall but we can be certain that it is because of new information whether it be increased earnings, economic standing, or a mishap within the company.

Let’s step back to the discussion of supply and demand. When supply is greater than demand, share prices will decrease.

Factors that Affect Stock Supply

- A company issuing additional shares

- The company buys back shares to reduce supply

- Investors selling stock to try and make a profit or when the share is losing too much value

Conversely, share prices increase when demand is greater than supply.

Factors that Affect Stock Demand

- Unexpected Events (examples include a natural disaster or economic downturn)

- Company News (that could be expected or unexpected)

- Industry Trends (such as the recent cannabis industry boom in the past 5 years)

- Economic Factors (that can include inflation, interest rates, etc.)

- Market Sentiment (the overall attitude of investors toward the market which could be psychological and not based on hard facts)

How Do You Buy Stock?

You can buy stock from either a public or private company. A public company will be listed on popular stock exchanges and will include all the big corporate names. Think McDonald’s, Starbucks, Microsoft, Facebook, and Tesla to name a few.

These companies were once private companies before they were traded on a public stock exchange. A private company will have a small number of owners and does not trade on a public exchange.

Say for example, you see a new restaurant open in your community. You cannot simply buy stocks from that company the same way you can with public companies. You must know the owners or be a qualified investor to be able to invest in the private company. In the same way, it can be difficult for the owners of private companies to be funded. When a private company is ready to expand to a public company, they announce an IPO (Initial Public Offering).

With public companies, you can buy easily buy stocks through your broker or through a brokerage account like Robinhood or E*Trade.

Public stocks are bought on what is called a stock exchange which is simply a place for buyers and sellers come together to exchange shares and money.

Examples of a stock exchange would be the New York Stock Exchange (NYSE) and Nasdaq (NASDAQ), which are the two largest stock exchanges in the world. While they are both similar for their purpose, they hold some clear differences. The NYSE is an auction market, where individuals can interact between each other while Nasdaq is a dealer’s market, having individuals trading through a dealer. The type of companies listed in a market is also a key difference between NYSE and Nasdaq.

An individual person cannot trade directly on a stock exchange; they must go through a broker or brokerage account. This broker acts as the middleman allowing access to the stock exchange and can provide a more intuitive way to trade for the inexperienced. Popular online brokers include E*TRADE, TD Ameritrade, Robinhood, Charles Schwab, and Fidelity.

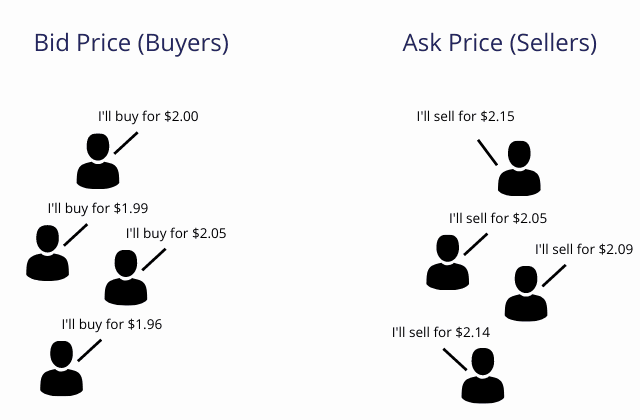

When you get to the point of buying a stock, you will be given the choice of buying it with different types of orders. Before you choose the type of order, it is important to understand first that each stock comes with a “bid” price and an “ask” price.

The “bid” price is what buyers are willing to pay for the stock.

The “ask” price is what sellers are willing to take for the stock.

So, when selling a stock, you sell at the bid price and when buying, you buy from the ask price. The difference between the bid and ask price is called a “bid-ask spread”.

The bid-ask spread is the amount in which the ask price exceeds the bid price for a stock. It is because of this that you must be careful in which type of order you choose since the price that is shown when placing a market order might be different than what you end up paying.

This is the basic function of the stock market which is considered an “auction” market. This means that buyers are competing on what they are willing to pay (bid price) for an item and sellers are competing on what price to sell an item (ask price).

When dealing with a liquid stock, the price difference may be a matter of pennies but could be quite different from an illiquid stock. It is essential to understand the difference when choosing which companies to invest in.

A liquid stock is a stock that can easily be sold for cash since there is a large volume of shares traded daily.

An illiquid stock is a stock that cannot be easily sold for cash without a large loss in value. They could be difficult to sell due to a lack of willing investors to purchase.

When beginning to dive into the stock market, it is a wise choice to start with liquid stocks as they can be less risky when it comes to selling.

Building a Stock Portfolio

Building a solid stock portfolio is important for any successful investor or trader. If you “put all your eggs in one basket” you could lose big time or miss out on other great opportunities. Understanding the four pillars of an optimized portfolio can help you become a better trader.

There are many different sectors that could be included in your portfolio: energy, finance, healthcare, technology. Some of these sectors will fluctuate at different times and evening out your portfolio across multiple sectors can bring more opportunities.

Read more articles about business.

When Do You Stop Being a Small Business?

There is a lot of advice and help out there for businesses just starting out – small businesses, in other words. However, this term doesn’t just refer to when you’ve only recently begun your entrepreneurial journey; it can still apply after years if you feel like...

Protect Yourself Against Mis-Sold Car Finance Deals

In recent years, car finance deals have become increasingly popular, offering many people an affordable way to drive the car they want without facing large upfront costs. While car finance can be a convenient and beneficial option, not all deals are as advantageous as...

Top 6 Test Automation Tools to Accelerate Your Development Cycle

Ready to speed up your software development and eliminate those pesky delays? Test automation is all that you need! Having the right automation tools can transform how you work. Picture this: quicker testing, fewer bugs, and smoother collaboration with your team....

Exploring Enterprise Resource Planning (ERP): Tool for Enhancing Business Opportunities

Enterprise Resource Planning (ERP) is a system which integrates management software. It allows organizations to access and manage data from the various departments of the organization. It improves efficiency, control and information flow in different functional areas...

4 Essential Tips for New Small Business Owners to Avoid Common Liability Risks

Starting a new business is exciting! You're turning your passion into reality. But with the thrill of entrepreneurship comes responsibility. One of the most important things is protecting your business from eventual losses. Tragic events can occur, and...

What to Expect From a Day in The ER in The US

A shift in the Emergency Room (ER) is a unique experience. So much can happen in minutes, let alone across the shift. If you're curious about what it's like, read on to find out how workers spend a day in the ER. The Calm Before The Storm Every ER...

0 Comments