If you have heard of the Boston Consulting Group matrix (or BCG matrix), the General Electric (GE) Matrix stands as an extension of that model, offering businesses a comprehensive framework for evaluating their portfolio of products or business units.

Since its inception in the 1970s, the GE Matrix (also known as the GE Mckinsey Matrix) has remained a cornerstone in the strategic planning toolkit, guiding businesses in making informed decisions about investment, growth, and resource allocation.

At its core, the GE Matrix is about assessing market opportunities and strengths of business units to chart the best course for a company’s success.

The historical background of the GE Matrix traces back to its development by McKinsey & Company for General Electric. The matrix was conceived as a more sophisticated alternative to the earlier Boston Consulting Group (BCG) Matrix.

While the BCG Matrix simplified business units into four categories based on market growth and market share, the GE Matrix introduced a more nuanced (or improved) approach.

It considered a wider range of factors affecting the market attractiveness and the sustainable competitive advantages of a business unit, thus providing a more detailed and flexible tool for strategic analysis.

Key Components of the GE Matrix

The GE Matrix is characterized by two primary dimensions: Industry Attractiveness and Business Unit Strength. Each of these dimensions is comprised of various factors that collectively determine the positioning of a business unit within the matrix.

Industry Attractiveness

This dimension evaluates the overall appeal of the market or industry in which the business unit operates. Is it an attractive industry or an unattractive industry? How does that affect your business portfolio?

Factors that contribute to industry attractiveness include market growth rate, market size, profit margins, competitive intensity, and technological developments. High industry attractiveness indicates a market that is lucrative and promising for investment.

Business Unit Strength

The strategic business units assess the ability of the business unit to effectively compete in its market – allowing for a competitive advantage.

Key considerations include market share, brand strength, customer loyalty, distribution network, and product quality. Strategic business units have the necessary capabilities and resources to outperform its competitors.

The Matrix Layout: Explaining the Grid

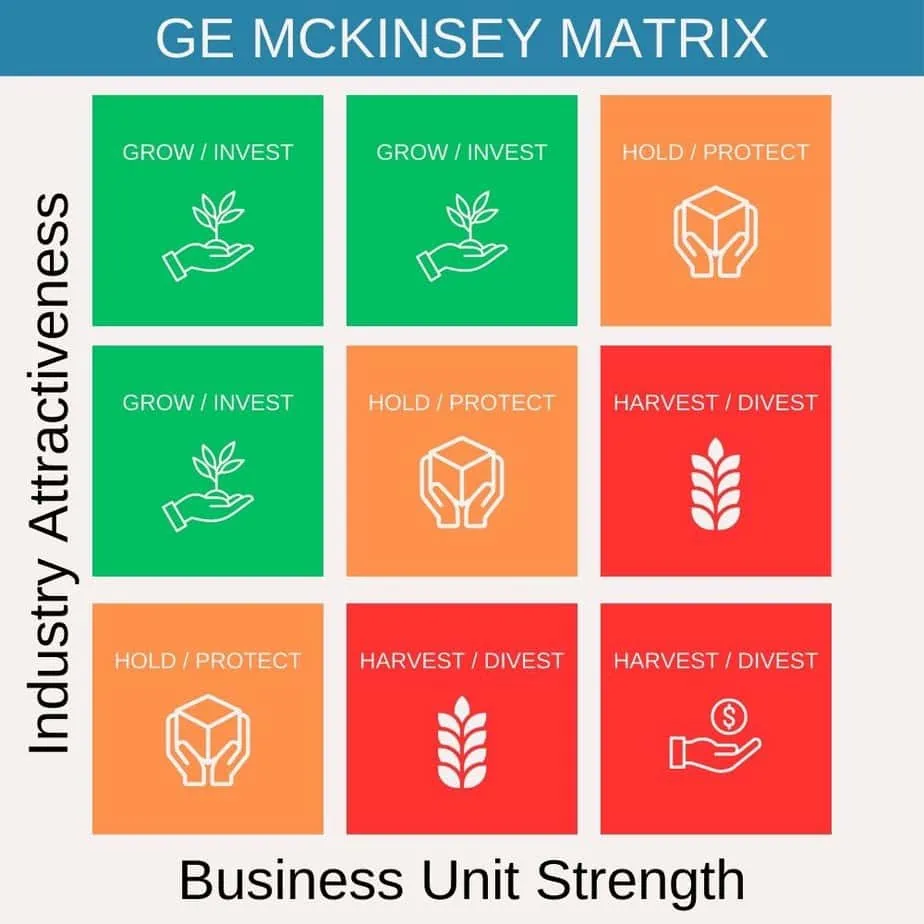

The GE Mckinsey Matrix is depicted as a 3×3 grid, usually divided into nine cells, with Industry Attractiveness on the vertical axis and Business Unit Strength on the horizontal axis.

Each cell within the matrix represents a different level of priority or strategic decision, ranging from high to low attractiveness and strength.

How the GE Matrix Works: A Step-by-Step Guide

Implementing the GE McKinsey Matrix in a business setting involves a systematic approach. Here’s a guide to effectively utilizing this strategic tool:

Identifying Business Units

The first step is to define the specific business units or product lines that will be analyzed. In large corporations, these might be various divisions or product categories. It’s essential to clearly define each unit to ensure accurate analysis.

Assessing Industry Attractiveness

For each business unit, evaluate the attractiveness of the industry it operates in. This involves analyzing market trends, growth potential, profitability, competitive intensity, and other relevant factors.

Each factor is typically rated on a scale (e.g., low, medium, high), and a composite score is derived to represent overall industry attractiveness.

Evaluating Business Unit Strength

Next, assess the competitive strength of each business unit. Examine factors such as market share, product quality, brand strength, marketing capabilities, and production efficiency.

Like industry attractiveness, these factors are rated and aggregated into an overall strength score.

Plotting on the Matrix

Based on the scores for industry attractiveness and business unit strength, plot each unit on the matrix.

The positioning within the nine-cell grid will indicate the strategic priority of each business unit – from invest and grow (top left) to harvest or divest (bottom right).

Interpreting the GE Mckinsey Matrix

The placement of business units within the GE Mckinsey nine box guides strategic decision-making:

Analysis of Different Quadrants

Units in the top left (high attractiveness, high strength) are ‘stars’ and typically warrant significant investment.

Units in the middle (moderate attractiveness, moderate strength) might require selective investment and strategies tailored to enhance their position.

Units in the bottom right (low attractiveness, low strength) are often candidates for divestiture or harvesting.

Strategic Implications Based on Positioning

The strategic actions for each business unit vary based on its position in the matrix. High-priority units might receive more investment in marketing, R&D, or capacity expansion, while low-priority units might be scaled back or divested.

The matrix helps in resource allocation, ensuring that resources are channeled towards units with the most potential for growth and profitability.

By following these steps, businesses can use the GE Mckinsey Matrix as a powerful tool to analyze and strategize their portfolios. The next sections will delve into the differences between the GE Matrix and the BCG Matrix, real-world applications of the GE Mckinsey Matrix through case studies, and strategic decisions informed by the matrix.

GE Matrix vs. BCG Matrix: Understanding the Differences

While both the GE Mckinsey Matrix and the Boston Consulting Group (BCG) Matrix are strategic tools used for portfolio analysis, they have distinct characteristics and applications:

Comparative Analysis

The BCG Matrix categorizes business units into four groups (Stars, Cash Cows, Question Marks, Dogs) based on two dimensions: market growth and market share. It’s simpler and focuses mainly on growth opportunities and cash flow.

The GE Mckinsey Matrix, however, is more complex and comprehensive. It assesses business units based on two broader dimensions: industry attractiveness and business unit strength, each comprising multiple factors. This allows for a more nuanced analysis.

Pros and Cons of Each Model:

The BCG Matrix is straightforward and easy to use, making it suitable for quick assessments. However, its simplicity can be a limitation as it might overlook certain nuances of business environments.

The GE Matrix’s more detailed approach provides a deeper and more flexible analysis, but it can be more time-consuming and requires more data to implement effectively.

Case Studies: Real-world Applications of the GE Mckinsey Matrix

To demonstrate the practical application of the GE Mckinsey Matrix, let’s explore a few real-world examples:

- Example 1: Application in the Technology Sector:

- A global technology company used the GE Mckinsey Matrix to evaluate its product lines, ranging from consumer electronics to enterprise solutions. The analysis helped the company prioritize investment in high-potential areas like cloud computing (high industry attractiveness and business strength) while scaling down less promising ventures.

- Example 2: Usage in the Consumer Goods Industry:

- A consumer goods company applied the GE Mckinsey Matrix to its diverse portfolio, including household products, personal care items, and food and beverages. The matrix informed decisions to invest heavily in the emerging organic products market (high attractiveness) and divest from stagnating segments.

- Example 3: Implementation in the Service Industry:

- A service-oriented business, offering everything from financial consulting to legal services, used the GE Matrix to determine where to focus its expansion efforts. The analysis highlighted the high potential in financial services due to strong market growth and the company’s competitive strengths in that area.

These examples showcase how businesses across various sectors use the GE Matrix to make informed strategic decisions, allocating resources effectively to maximize growth and profitability.

The next sections will discuss the strategic decisions that can be informed by the GE Matrix, including investment strategies and how to tailor these strategies for different business units, followed by an examination of the challenges and limitations of the GE Matrix.

Strategic Decisions Based on the GE Matrix

The GE Matrix not only provides an analysis of a business’s current competitive position, but also informs various strategic decisions. Depending on where a business unit falls within the matrix, different strategies can be adopted:

Investment Strategies: Build, Hold, Harvest, Divest

Build: For business units in attractive industries with strong competitive positions, the strategy is to invest and grow. These are areas where the company can capitalize on its strengths and the lucrative market.

Hold: Units that are in moderately attractive industries or have moderate strength might warrant a ‘hold’ strategy. This involves maintaining the current level of investment and resources to protect the existing market share and industry profitability.

Harvest: For units in less attractive markets or those with weaker competitive positions, a harvest strategy can be implemented. This means deriving maximum short-term profits with minimal investment.

Divest: Business units that fall into the low attractiveness and low strength quadrant are often candidates for divestiture. Divesting frees up resources that can be better used in more promising areas.

Tailoring Strategies for Different Business Units

The GE Matrix helps in customizing strategies for each business unit based on its unique market position.

For instance, a business unit that is a market leader in a growing industry might focus on innovation and expansion, whereas a unit in a declining market might focus on cost-cutting or even exiting the market.

This tailored approach ensures that each part of the business is following a strategy that aligns with its market conditions and internal capabilities.

Challenges and Limitations of the GE Matrix

While the GE Matrix is a valuable tool, it comes with its set of challenges and limitations:

Recognizing the Shortcomings

One of the main challenges of the GE Matrix is its complexity. The matrix requires in-depth market analysis and a clear understanding of various internal and external factors. This can be resource-intensive and may not always yield precise results.

The subjective nature of assessing factors like market attractiveness and business strength can also lead to biases in the analysis. Different individuals or teams might evaluate these factors differently, affecting the consistency and reliability of the outcomes.

Mitigating Potential Biases and Errors

To minimize biases, it’s essential to have a diverse team involved in the analysis and to rely on objective data as much as possible. Regular reviews and updates to the matrix can also help in keeping the analysis aligned with the current market conditions.

Despite these challenges, the GE Matrix remains a powerful tool for strategic planning, especially for businesses with diverse portfolios. Its ability to provide a nuanced view of a company’s strategic position makes it invaluable in guiding long-term business strategies.

The GE Matrix in the Modern Business Environment

The contemporary business landscape, marked by rapid technological advancements and shifting market dynamics, poses new challenges and opportunities for strategic planning. In this context, the GE Matrix remains a relevant and adaptable tool for businesses seeking to navigate these complexities.

Relevance in Today’s Market

Today’s business environment is characterized by fast-paced change, increased competition, and a greater emphasis on innovation and agility. The GE Matrix helps businesses not only to assess their current position but also to anticipate and prepare for future market trends. Its comprehensive approach allows companies to evaluate potential risks and opportunities in their industries and adjust their strategies accordingly.

Adapting the GE Matrix for Contemporary Business Challenges

To stay relevant, the GE Matrix can be adapted to incorporate modern metrics and data analytics. For instance, integrating data from digital marketing channels can provide more precise insights into customer preferences and market trends.

The matrix can also be used in conjunction with other strategic tools, like SWOT analysis or PESTLE analysis, to provide a more rounded view of the business environment. This multi-faceted approach is particularly beneficial in understanding the impacts of external factors like technological disruption, regulatory changes, or socio-economic shifts.

Advanced Insights: Beyond the Basics of the GE Matrix

To maximize the potential of the GE Matrix in strategic planning, businesses can delve deeper into advanced techniques and integrations.

Integration with Other Strategic Tools

The GE Matrix can be effectively combined with other strategic models and frameworks. For example, integrating it with Porter’s Five Forces can enhance understanding of industry structure and competitiveness, while alignment with the Value Chain Analysis can help in identifying internal areas of strength and weakness.

Advanced Techniques for More Accurate Analysis

Advanced analytical techniques, such as predictive modeling and scenario planning, can be used alongside the GE Matrix to forecast future industry trends and business unit performance. This forward-looking approach is crucial in today’s dynamic business environments, where anticipating change is as important as reacting to it.

Conclusion

In conclusion, the GE Matrix is a versatile and powerful tool in the arsenal of business strategy. Its ability to dissect and analyze the various dimensions of business units within an industry makes it invaluable for decision-makers.

In the ever-changing competitive landscape of modern business, the GE Matrix continues to offer relevant insights, guiding companies toward strategic growth and sustained success. By embracing its principles and adapting them to contemporary challenges, businesses can navigate complexities with greater confidence and clarity, ensuring they remain competitive and agile in the global market.

0 Comments