When it comes to marketing theories, the Boston Consulting Group (BCG) Matrix stands out as a pivotal analytical tool, guiding businesses in portfolio management and strategic planning.

Developed in the 1970s by the Boston Consulting Group, this growth share matrix has become a fundamental part of strategic business analysis.

At its prime, the BCG Growth-Share Matrix was used by over half of the Fortune 500 companies. While it is not as widely used today, it is still an integral part of marketing theory teachings in business school.

Its main purpose is to help companies evaluate their product lines or business units in terms of growth prospects and market share.

The BCG Matrix provides a straightforward approach to understanding where a company’s strengths lie and where it may need to make adjustments for long-term success.

Core Concepts of the BCG Matrix Model

At its core, the BCG Matrix is based on the concept of product life cycles and market dynamics.

It allows a market leader to come up with a cost advantage that is not easily replicated by competitors.

The idea is that if a business wants to gain market share, then they will need to provide a significant investment in a competitive package.

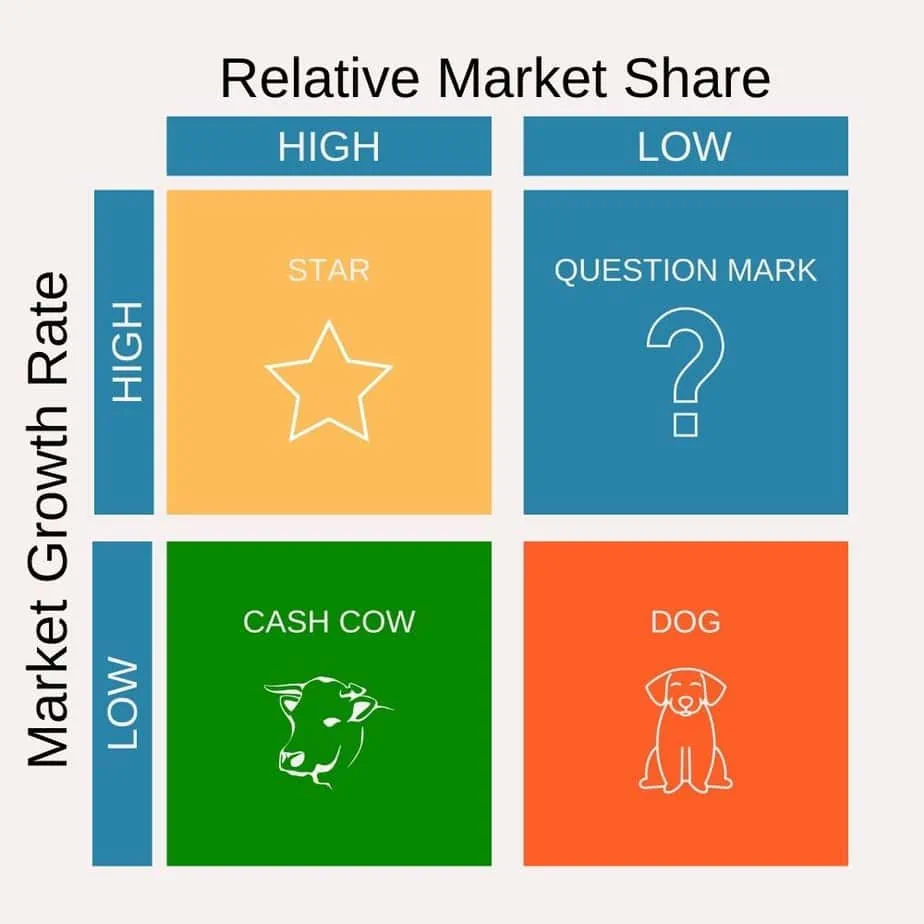

The growth share matrix classifies business units or products into four distinct categories – Stars, Question Marks, Cash Cows, and Dogs.

These categories are determined based on two key factors: market growth rate and relative market share.

Market Growth Rate

This factor assesses the market attractiveness by evaluating the growth rate of the overall market in which the business unit operates. A high growth rate implies a growing market with potential opportunities for expansion.

Relative Market Share

This measures the strength or dominance of a business unit in its market, compared to its competitors. A high market share indicates a strong, well-established position in the market.

Strategic Implications of Each Quadrant

Each quadrant of the BCG Matrix suggests a different strategic role for the business unit:

Stars: High-Growth, High-Share

These units have high market growth and high market share. They are leaders in a growing market and typically require substantial investment to maintain or grow their position. Stars are seen as potential market leaders and can generate significant revenues.

Question Marks: High-Growth, Low-Share

Characterized by high market growth but low market share, these units are risky. They require a lot of cash to increase market share but have the potential to become Stars. The key strategy here in these high growth markets is to invest heavily or divest.

Cash Cows: Low-Growth, High-Share

With low market growth but high market share, these units are the profit generators for a company. They require little investment and produce steady cash flow. The strategy is usually to maintain and harvest profits.

Dogs: Low-Share, Low-Growth

These have both low market growth and low market share. They are often seen as non-viable in the long term and are candidates for divestiture. The strategy here is usually to minimize investment and consider phasing out.

Applying the BCG Matrix in Business

Implementing the BCG Matrix in a business context involves a structured approach:

- Identifying and Categorizing Business Units: Start by listing all business units or products and categorizing them into one of the four quadrants of the BCG Matrix. This categorization is based on their market growth rate and relative market share.

- Evaluating Market Growth and Market Share: Analyze market data to determine the growth rate of the market each unit operates in and its position relative to competitors. This will involve market research and analysis of internal data.

- Strategic Recommendations for Each Category: Depending on which quadrant a business unit falls into, develop specific strategies. For instance, invest in Question Marks with potential to become Stars, while managing Cash Cows to support these investments.

The BCG Matrix is a straightforward yet powerful tool that can guide businesses in making informed strategic decisions about where to allocate resources for maximum impact and profitability. The next sections of the article will delve into real-world applications and examples of the BCG Matrix, its advantages and limitations, and its modern-day adaptations and relevance.

BCG Matrix in Practice: Case Studies

To illustrate the practical application of the BCG Matrix, let’s consider a few real-world examples from various industries:

- Technology Industry Example: A tech company used the BCG Matrix to categorize its diverse range of products. Its emerging AI technology was classified as a Question Mark due to its high growth potential but low market share. In contrast, its established software suite was a Cash Cow, commanding a high market share in a mature market.

- Consumer Goods Industry Example: A consumer goods company applied the BCG Matrix to its product line. A newly launched health drink, rapidly gaining popularity, was identified as a Star. Meanwhile, an older line of household cleaning products, stable but with little growth, was categorized as a Cash Cow.

- Automotive Industry Example: An automotive manufacturer used the BCG Matrix to strategize its portfolio. Its electric vehicle range, in a high-growth market but with fierce competition, was seen as a Question Mark. In contrast, its line of diesel trucks, in a declining market but with a strong customer base, was a Dog.

Advantages and Limitations of the BCG Matrix

The BCG Matrix is a valuable tool, but like all models, it has its strengths and weaknesses:

Advantages:

The BCG Matrix is straightforward and easy to use, providing clear visualization of a company’s product or business unit portfolio.

It assists in resource allocation decisions, helping companies prioritize investments in products with the most growth potential.

Limitations:

The model relies heavily on the market growth rate and market share as the only factors, which can oversimplify complex market dynamics.

It may not accurately reflect the potential of newer markets or products that have not yet achieved high market share but have high potential.

Modern Applications and Adaptations of the BCG Matrix

In the dynamic business environment of today, the BCG Matrix continues to be relevant, with certain adaptations:

- Integration with Digital Metrics: Modern businesses often integrate digital analytics into the BCG Matrix analysis, using online consumer engagement and digital market trends as additional factors.

- Application Across Diverse Markets: The BCG Matrix is adaptable to various markets, including digital services and emerging technologies, where traditional market share and growth rates may be interpreted differently.

The Origins of the BCG Matrix: Bruce Henderson’s Contribution

The concept of the Boston Consulting Group (BCG) Matrix is closely tied to the insights of Bruce Henderson, the founder of BCG. Henderson was instrumental in popularizing this strategic tool through his pivotal essay, “The Product Portfolio.”

Published in the 1970s, this essay laid the groundwork for what would become a seminal model in business strategy.

In “The Product Portfolio,” Henderson introduced the idea of categorizing a company’s offerings into a matrix based on market growth and market share.

His innovative approach provided businesses with a clear, visual method for evaluating their product lines and making informed strategic decisions.

This essay not only cemented Henderson’s legacy in the field of management consulting but also marked the beginning of the widespread adoption of the BCG Matrix in corporate strategy.

Conclusion

The Boston Consulting Group Matrix remains a powerful tool for strategic business analysis. It offers a simplified yet effective way to visualize and strategize business units or product lines based on market growth and relative market share.

While it has limitations, its adaptability and straightforward approach make it a valuable model for businesses looking to optimize their product portfolios in today’s rapidly evolving market landscape. By understanding and applying the principles of the BCG Matrix, companies can make more informed decisions about where to focus their efforts and investments for long-term growth and success.

0 Comments