Different Types of Candles on a Candlestick Chart

Different Candlestick Types to Know

- Big Candles

- Dojis

- Gravestone / Dragonfly

- Shooting Star / Hammer

- Morning Doji Star / Evening Doji Star

- Bearish Harami / Bullish Harami

- Engulfing Bullish / Engulfing Bearish

Before we dive into each candlestick type, why would we even use a candlestick chart?

Candlestick charts can give you a variety of information if you understand patterns and trends. Using the knowledge of the different types of candlesticks can help you piece together patterns, which will lead to more successful and potentially profitable choices.

Why Not Use the Line Chart?

The line chart is the most basic and simplest chart available when reviewing the history of a stock. It displays a series of closing prices and connects them by a line that can be viewed by day, week, month, or year.

While this chart is simple and shows prices and patterns over time, the information it gives is quite limited. That is why most professional brokers and experienced traders will use candlestick charts instead of line charts.

In fact, every professional (and amateur) trader I know uses TradingView to keep track of their stocks- being the most extensive charting application online. The free version is great and allows for many functions for a beginner trader but a PRO plan will allow you multiple alerts and charts in one tab to keep a close eye on important movements in stocks.

The Candlestick Chart

The candlestick chart is the same as the line chart but includes much more detailed information on the pricing of the stock.

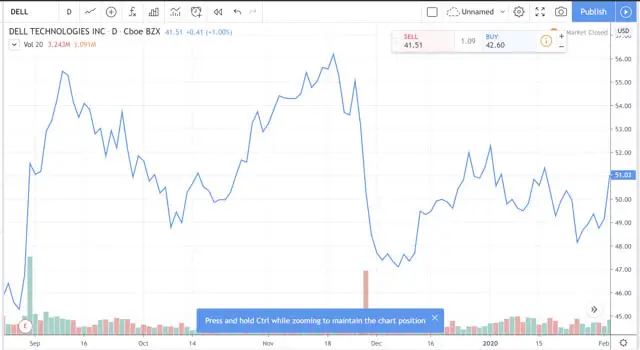

For example, let’s take a look at this line chart for Dell.

We can tell that in late November 2019, the price plummeted down from $56.21 to $47.03 but we want to know how it happened– which this chart does not tell us.

If we look at the same company with a candlestick chart, we can gain more valuable insight on what happened. For each day, we can determine the open price, close price, high price, and low price. In order to understand the candlestick chart, it is first good to understand the basic concept of a candlestick.

Candlesticks Explained

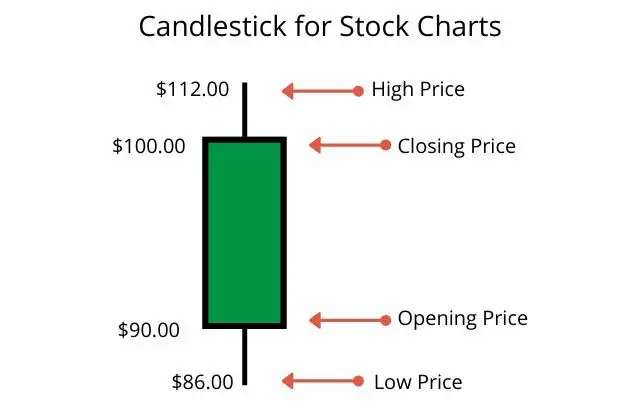

A candle shows the opening, closing, high, and low price for a certain time period. When a candle goes up in a time period, it is colored green and if it goes down, it is colored red. An example of this is given in the illustration below.

For this candle, the first trade of the day began at $90 (which is the opening price) and then moved around until the last trade of the day closed at $100. This was a $10 price increase which makes it a green candle.

Notice the lines above and below the main body of the candle. This is where the price fluctuated even though it did not open or close at those prices.

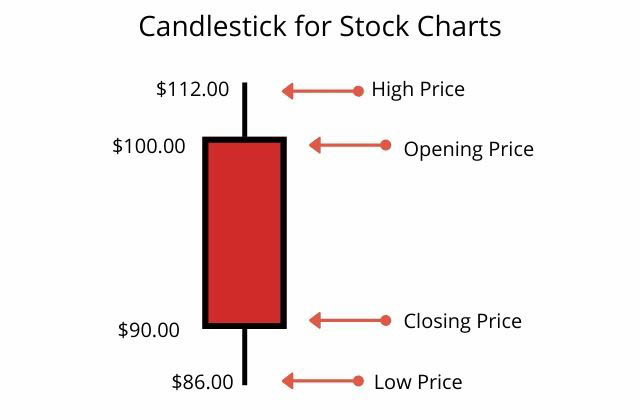

This example would be a candle with a decrease in price where the opening price began at $100 and closed at $90.

Candles do not have to be set at a specific span of time. They can be set to represent a single day, a whole month, or even as low as a single minute.

Here are the candles for different time spans for the company Exxon Mobil.

1-year chart with Candles by Day

3-month chart with Candles by Hour

1-day chart with Candles by Minute

You will notice that the candles take on many different forms and sizes. Identifying different types of candles can help with spotting trends.

Ready to start trading stocks? Don’t make the rookie mistake of losing money by going in blind without a mentor. If you want to do it right, check out Timothy Sykes, the leading name in swing trading penny stocks.

Different Types of Candlesticks

- Big Candles

- Dojis

- Gravestone

- Dragonfly

- Shooting Star

- Hammer

- Morning Doji Star / Evening Doji Star

- Bearish Harami / Bullish Harami

- Engulfing Bullish / Engulfing Bearish

Let’s explore each type of candle and how it can help you predict patterns and trends.

Big Candles

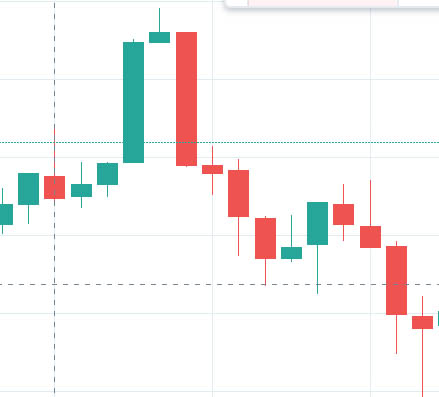

Big Candles are self-explanatory since they are large candles with major price differences.

Here is a segment of a candlestick chart that has an example of a big candle compared to a small candle.

The small candle might have been a $0.20 drop in price where the big candle might have been a $2.00 drop in price. The important thing to note is that big candles are drastic changes in price whether it be increasing or decreasing.

A candle tells us about the current supply and demand during the lifespan of the candle. A big candlestick that decreases in price means that during that time, supply was much higher than demand. If the candle increases in price, then demand was higher than supply.

For example, this chart has an exceptionally large drop on this day and is marked by a big red candlestick.

We know right away that supply was much higher than demand on this day- but why such a large drop?

We can assume that there might have been some news or information that caused such a drastic change in price. Let’s explore another candlestick form known as a Doji.

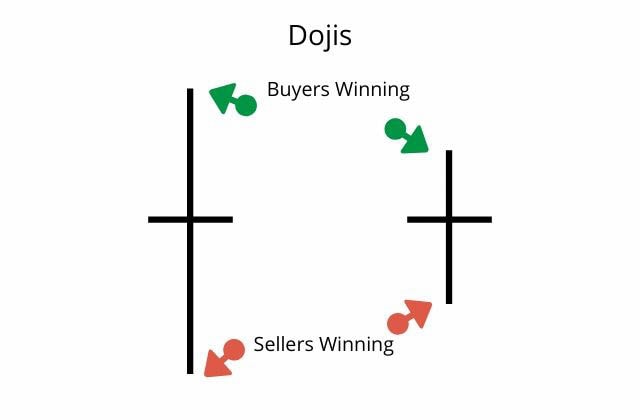

Dojis

A doji is a candle that fluctuates in price during a certain period but opens and closes at the same price. The period could be 1 day, 1 hour, or even one minute. The synopsis is still the same- which is that there is uncertainty in the market.

At one point, buyers were winning and at one point sellers were winning but it ended up closing at the same price as when it opened. If the candle wick is large, then that simply means that there is higher indecision than a doji with a small wick.

Dojis by themselves tell us that there is indecision on the price but does not tell us much beyond that. Although, if using them with other candle stick patterns, you might be able to learn more about how the stock price is going to move. Two of patterns are the morning doji star and the evening doji star.

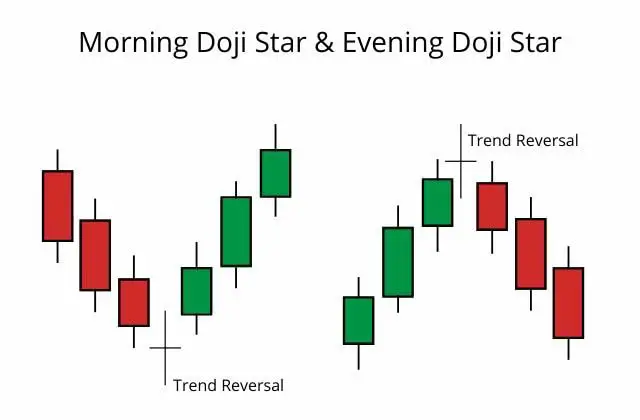

Morning Doji Star and Evening Doji Star

These patterns use the doji to mark a possible trend reversal. If the candles are moving down and then hit a doji and begin moving up, this would be an example of the morning doji star. The opposite pattern where the doji marks a trend reversal going down, then that would be an example of an evening doji star.

The morning and evening doji stars are not going to tell you what stocks you should purchase.

You should not simply see this pattern and rush to go purchase.

But, if you have already chosen a stock based on your strategy, this pattern will help tell you the best timing to enter the market.

Also, do not get caught up on searching for a doji that has an exact match with the opening and closing price. It could also have a small body with similar opening and closing prices. The point is to have the knowledge of being able to identify the pattern for market entry.

This is an example of a good time to enter the market. The small candle at the bottom is an indicator that the pattern is shifting and there is a trend reversal. It would likely be a good time to purchase after the stock bottomed out and showed promise for growth.

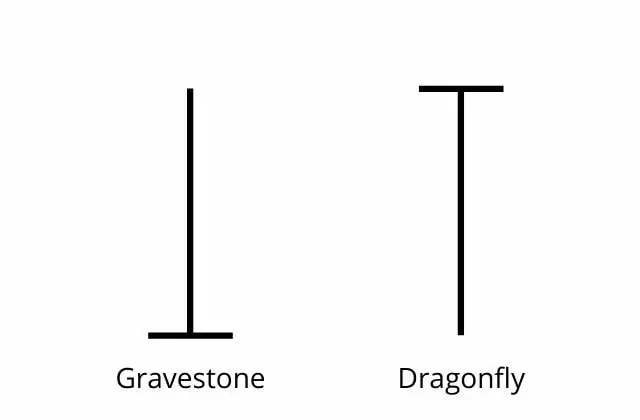

Gravestone and Dragonfly

These two forms of a candle are like the doji in that they open and close at the same price, but they only fluctuate in one direction: increasing or decreasing.

Similar to the doji, they will not be very helpful by themselves but using them with other candle forms can help predict the future of a stock.

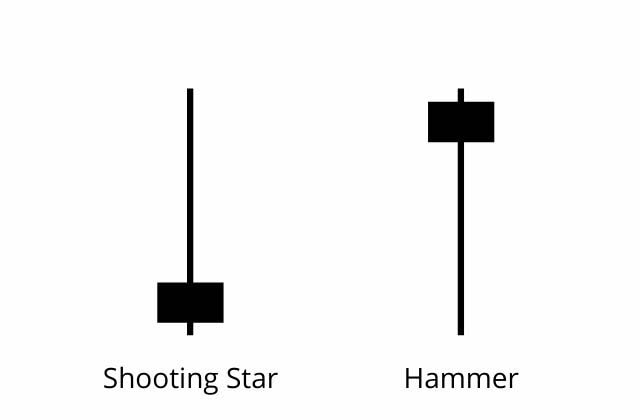

Shooting Star and Hammer

A shooting star is where the stock opens at a price and goes up and then goes down to close just above where it opened. It is almost identical to the gravestone but instead closes just above the opening price rather than closing at the same price.

The same goes for the hammer. The hammer is where the price opens and the goes down a bit and back up to close just below the opening price. This pattern is closely related to the dragonfly candle type.

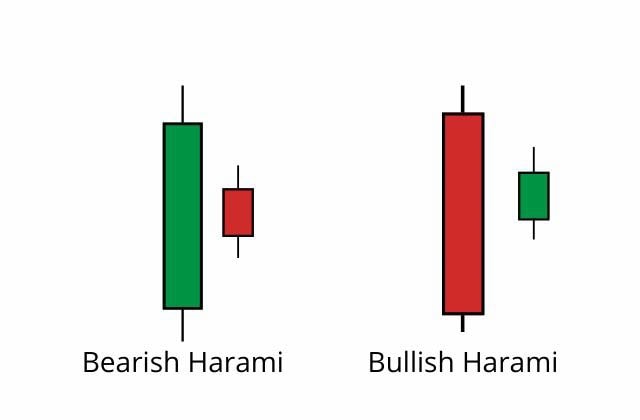

Bearish Harami and Bullish Harami

These patterns consist of a large candle followed by a smaller candle that is contained within the body of the first candle. The bearish harami signals a reversal pattern to the downside while the bullish harami signals to the upside.

This pattern strongly suggests that the current situation will reverse. Let’s look at an example of what that might look like on a candlestick chart.

Here we see that the demand was higher than supply for a good streak. The buyers were winning. Then once it reached a certain price, the next opening price was lower and the closing price decreased from there. This is a strong indicator that there is going to be a trend reversal and the stock is going to change direction. This tells us that once the stock reached a certain price, it got exhausted and sellers were able to take over the market.

Engulfing Bullish and Engulfing Bearish

This pattern is where a small candlestick is followed by a larger opposite candlestick that fully engulfs the first one.

Here is an example of an engulfing bearish pattern.

We see that the buyers are buying the driving the price up for some time. Then at the peak, a large red candlestick engulfs the small green candlestick- signaling a trend reversal. This is a strong signal because it tells us that the sellers are overpowering the buyers- and by a lot since it completely engulfs the previous candle.

Are these all the Candlesticks to Know?

There are many more candlesticks that have names attached to them but they are not as important. If you spent all of your time memorizing candlestick names and all of the different types, then you would be missing the point.

The goal here is not name memorization. It is about understanding how certain candles can potentially predict behavior when placed in a pattern.

Read more articles about business.

What to Expect From a Day in The ER in The US

A shift in the Emergency Room (ER) is a unique experience. So much can happen in minutes, let alone across the shift. If you're curious about what it's like, read on to find out how workers spend a day in the ER. The Calm Before The Storm Every ER...

The Importance of Personal Development Courses for Self-Growth

Personal development is any activity enhancing an individual's knowledge, skills, happiness, or well-being. Investing in personal development can provide immense benefits in both professional and personal contexts. Structured courses offer valuable frameworks for...

How to Rent a Phone Number for Receiving SMS in the USA

In today’s society inclusion of a US phone number can greatly improve your ability to communicate with others. It is very useful if you are a small business owner starting a business in the USA, an international student needing a local phone number, a digital nomad...

How 3PL Fulfillment Enhances Personalization In Digital Marketing

Digital marketing success often has effective personalization at its center: the customer must feel like you know who they are, know their pain points, and that your product or service speaks directly to them without mincing words. But achieving this...

Embroidery Design Optimization Guide For Search Engines

This is probably one of the best decisions if you have decided to rank your embroidery design website on search engines. If you are able to get a suitable ranking on Google and other search engines, SEO can help your digitizing business in many ways. It will not only...

The Varied United States Locations For Corporate Retreats

A corporate retreat is the ideal opportunity to reward your team with a break. Whether the year has been pretty easy with massive profits and new clients, or it's been a little challenging and stressful, time away can really help. Your employees get to socialize and...

Measuring Your Return on Investment From Branded Products

Every business needs a strong brand identity. Branded products, from apparel to custom gifts, offer a tangible way to do just that. These items don’t just boost recognition; they stick around, creating a long-term bond with your audience. But are they worth the spend?...

Understanding IFZA Free Zone License Costs: Maximizing Business Growth and ROI in Dubai

The International Free Zone Authority (IFZA) in the geographical area of Dubai has become a favorite destination for business and company owners and entrepreneurs organizing their regional company formation in the United Arab Emirates. Being located in one of the...

Grounding in Personal and Professional Growth: Techniques for Focus and Success

Ever feel like life's pulling you in a million directions at once? Grounding can be the anchor you need to stay focused and balanced. Whether you're aiming for personal development or professional success, grounding techniques help you reconnect with your core values...

The Definitive Guide to Conversion Rate Optimization (CRO) Services

In increasingly competitive digital markets, companies must maximize conversions securing leads visiting websites and eventually becoming customers. Conversion rate optimization (CRO) services enhance website experiences and processes driving higher...

The Benefits of Implementing Enterprise Search as a Service for Improved Efficiency and Productivity

In the ever-evolving digital workplace, swiftly locating and utilizing information has become a linchpin of efficiency and productivity. Enterprises are swamped with data, often siloed across various departments and formats, making it a challenge to access the right...

Experience Kits: Crafting Memorable Moments

Social interactions are increasingly being replaced by screen interactions in this digital age and that is why the idea of experience kits is rather distinct and appealing to the target groups These specially selected and put together packages have been...

0 Comments